How to Get Value from Net Promoter Score?

Have you taken the time to figure out how much it costs to generate sales from new customers? A lot of work goes into it, and a lot of money. Then, compare that to getting repeat business from a returning customer. Aside from servicing their needs and keeping them happy, there’s next to no cost involved. On top of that is the potential for new business and customers from positive customer recommendations. That’s why customer loyalty is such a key part of business and Net Promoter Score is so important.

One of the ways to measure customer loyalty is by using surveys. It’s a great way to find out what people like and what could be improved. But one particular survey, Net Promoter Score®, specifically measures customer loyalty. So, how do you get value from Net Promoter Score?

Here’s a little more about Net Promoter Score® (NPS®), and how you can maximise its value.

Understanding Net Promoter Score®

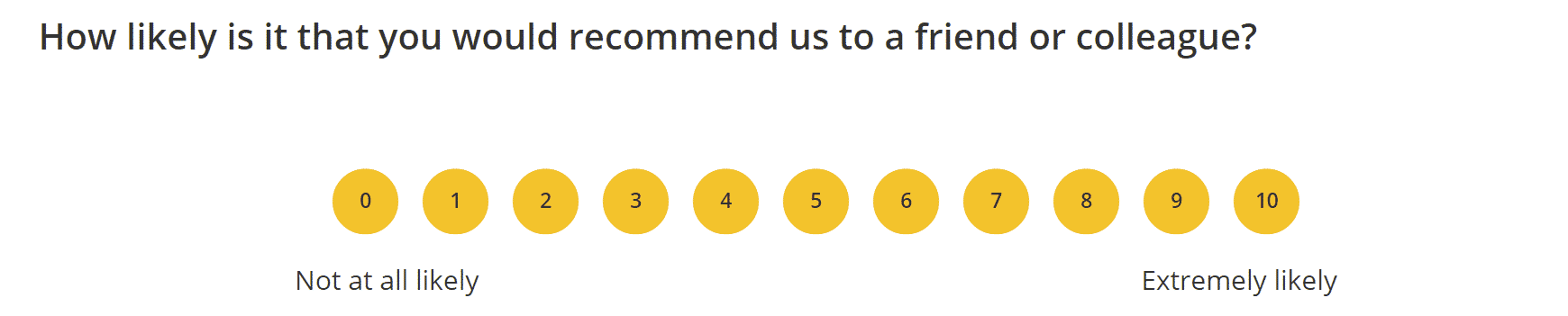

NPS® is an extremely simple survey to run, because it asks one main question. You’ve probably seen it many times before on customer surveys, and that question is: ‘How likely are you to recommend this product or service to a friend or colleague?’

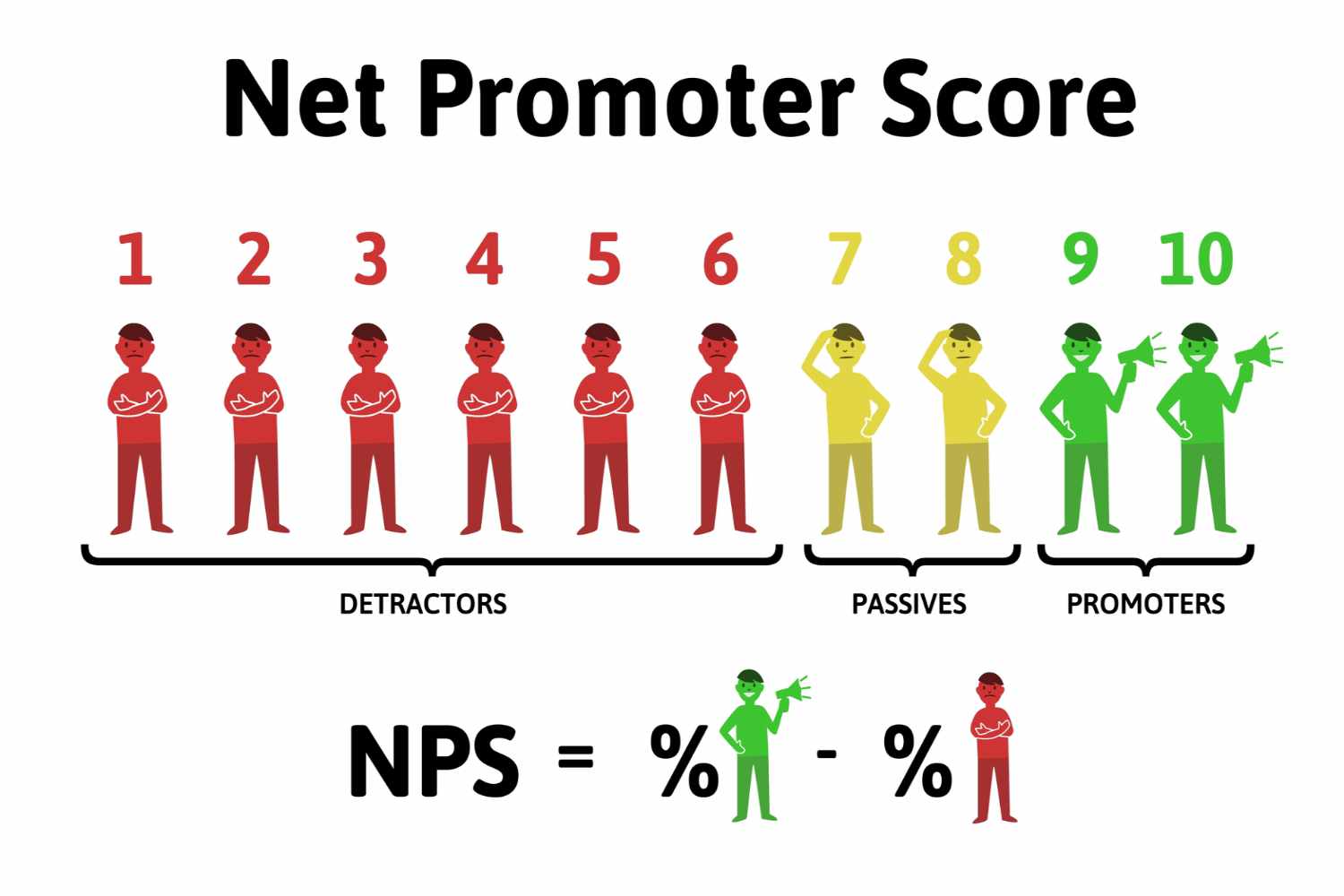

Customers respond with a rating between 0 and 10, and the results are grouped into the following categories:

- 9-10: Promoters

- 7-8: Passives

- 0-6: Detractors

The goal is to maximise the number of Promoters above Passives or Detractors. Once you’ve captured a good number of responses, you use an equation to reach your total NPS score:

% of Promoters – % of Detractors = NPS Score

You’ll notice that Passives aren’t really included in the final equation, because they aren’t likely to promote your business or share a negative experience. For more information on calculating your NPS, you can check our handy guide here.

Comparing your NPS®

Once you’ve determined your NPS, it’s important to measure it in a number of different ways. This is because a good NPS score in a certain industry or region may look very different to others. For example, in the food service industry, people may be more inclined to judge your business harshly, meaning it’s difficult to get high numbers of Promoters. Other industries may naturally have a lot of Promoters and Passives but very few detractors.

Cultural factors also play a role. As an example, in the Western world people are very open and honest with ratings, whereas in some Asian societies it would be considered impolite to rate a business too lowly.

For accurate results, you need to compare your score against similar businesses in your region. Perhaps most importantly, you also need to compare against yourself. We’ll talk a little more about that later, but naturally if you’re running customer surveys regularly, you want to keep improving.

Analysing your results

So, once you’ve calculated your score and checked it against your industry and region, it’s time to analyse the results more closely. We often get asked ‘what is a good Net Promoter Score?’, but the answer can be a quite variable depending on a range of factors as mentioned. The first time you measure your NPS creates an internal benchmark and progress over time becomes important. The table below is a rough guide.

- -100 – 0: Needs improvement

- 0 – 30: Good

- 30 – 70: Great

- 70 – 100: Excellent

The real answer lies in the breakdown of your results, specifically looking at what percentage of your customers fall into each category. For example, Company X has 70% Promoters, no Passives, and 30% Detractors. The score would be 40, which is considered great. But they may want to look at why so many people are responding as Detractors.

By the same token, Company Y had only 50% Promoters, 50% Passives and no Detractors. This gives them a score of 50, only marginally above Company Y, even though they’ve got nobody responding poorly. The goal then becomes how to move those 50% passive customers into the Promoter range.

Follow up with more detailed surveys

To get real value from your NPS, you often need to dig deeper into the results. In the examples above, Company X would love to know what they got so wrong to warrant 30% Detractor responses. Company Y wants to know what they can do better to make their 50% passive responses more positive.

One way to do this is with follow-up surveys. By asking more questions about the customer experience, you may start to see trends. Is your pricing too high? Are the products as described on your website? Were there problems with your delivery services?

Once you identify specific areas of improvement, you can work towards improving your NPS next time.

Make a solid action plan

With any type of survey you do, whether it be with customers or internal organisational surveys, you need to use the results wisely. If you don’t intend to make real changes following poor survey results, you mas well not do the survey at all.

You shouldn’t feel attacked by your survey results, rather use them as constructive criticism. At the end of the day, happy customers mean more profits. Loyal customers are even better, because they’ll be back again and will probably tell their friends.

So, after you’ve pinpointed what may not be working as well as it could, commit to taking action. Make a plan for how you can resolve these customer pain points and provide an overall better service. Like any action plan, set clear timelines, because the final step in the chain is to reassess your NPS.

Reassessing your NPS®

NPS is a customer satisfaction metric that needs to be assessed regularly. Even if you do the survey once and get a great score, you need to maintain that level of performance. Without regularly checking in with your customers, you may never know if your service is falling short.

You don’t need to bombard your customers with surveys every week. But once every 6 months, or even annually, it’s a good idea to find out how you’re going. This is eve more important if you made a solid action plan and made changes to improve the customer experience. Once your changes have been embedded for a while, it’s great to do another NPS survey to gauge whether you’ve improved or not.

Surveys form part of the long-term success of a business. They’re not a quick fix, and sometimes you’ll need several surveys to get the information you really need. But a great starting point is the NPS survey. Because at the end of the day, there’s no better customer than a loyal one.

Acknowledgement

Net Promoter®, NPS®, and Net Promoter Score® are trademarks of Satmetrix Systems, Inc., Bain & Company, and Fred Reichheld.